Our Solution

Seamless Crypto Spending

Convert your crypto assets into instant spending power-guickly and easily. No technical expertise needed.

Multi-Network Top-Ups

Top up your card using popular tokens like BTC, ETH, and USDT across ERC-20, TRC-20, BEP-20, and Polygon networks. Flexibly and Securely.

Two Tailored Card Tiers

Whether you’re a casual user or a power spender, we’ve got the right solution for everyone. Choose between the Elite or Black card.

Modern Support, Human Touch

From instant AI assistance to human support when you need it, we’re here. With Privacy at the Core

Your Assets, Your Choice

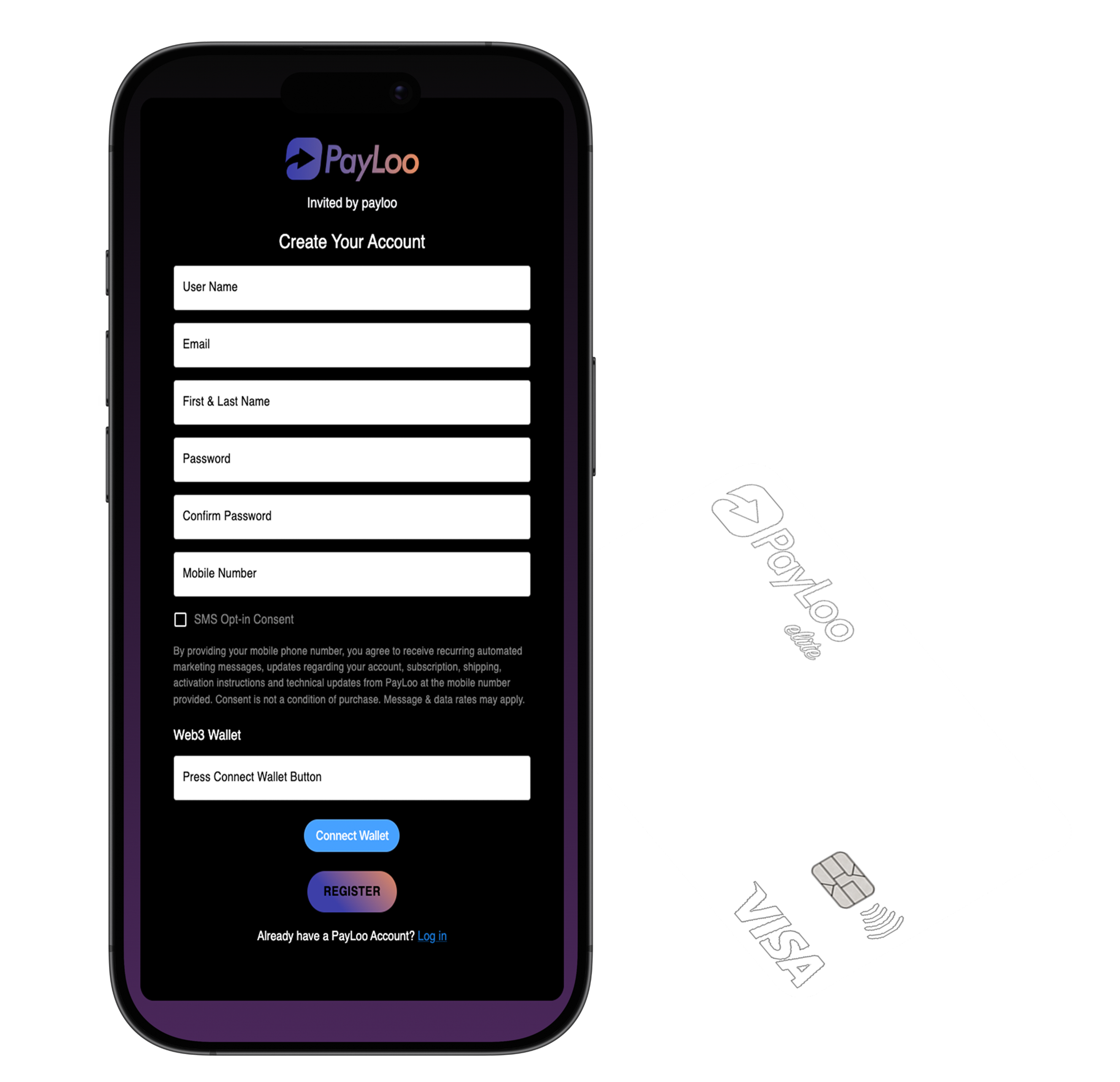

Our Innovation

Experience seamless crypto spending with the PayLoo Visa Card—no conversions, no complexity. Top up in BTC, ETH, or USDT across multiple networks and choose from flexible card options designed for your lifestyle. With modern support solution, top-tier privacy, and real-world usability, PayLoo redefines how you use your crypto every day.

Fast. Secured. Unstoppable.The Way Crypto Spendnig Should Be

At PayLoo, your security comes first. We don't store your crypto-funds flow securely to our partners, converted to fiat, and loaded onto your card. If anything looks off, you can freeze your card anytime from your dashboard. Your assets stay private, with you in control.

Your Digital Assets At a Fingertips. Anytime. Anywhere.

PayLoo, makes your crypto instantly spendable -whether you're grabbing coffee, booking a flight, or shopping online. Our unique metal Visa cards are designed for everyday use and accepted anywhere Visa is accepted worldwide. No manual conversions, no wallets to manage— just a sleek metal card powered by BTC, ETH, and USDT. Backed by real-time security, global access, and zero custodial risk, PayLoo puts your crypto in motion.

Elite or Black - You Decide

Whether you're new to crypto spending or moving significant value, PayLoo has the perfect card. The Elite Card offers secure, everyday access to digital assets with zero complexity. Looking for more power? The Black Card delivers higher limits, lower fees, and priority processing —built for serious spenders. Both cards are backed by real-time security features, global usability, and the freedom to top up with your favorite tokens.

Elite

$

Black

$

Frequently Asked Questions

Got questions? We've got answers. Whether you're curious about top-ups, card limits, fees, or how PayLoo works behind the scenes. Explore our most common questions to get clarity and confidence—fast, simple, and always up-to-date.

BTC

ETH

USDT (ERC-20, TRC-20, BEP-20, Polygon)

Always double-check the network before sending to avoid irreversible loss of funds.

Elite Card: Ideal for regular users with standard limits.

Black Card: Designed for high-volume users, offering higher limits, lower fees, and priority processing.

- A valid government-issued ID

- A proof of address, such as a recent utility bill, bank statement, or credit card statement

No selfie or asset verification is required. Fast, simple, and globally accessible.

Monthly top-up: 175,000 USDT

Per transaction: 150,000 USDT

Monthly spending limit: 150,000 USDT

Elite and Black cards offer different thresholds to match your needs.

ATM withdrawal: 1% + 4 USD

While top-up fees are fixed by card tier, the final fee may slightly vary based on the token used, blockchain network, real-time congestion, or conversion rates — these are not hidden fees, but network-based adjustments to ensure secure and timely processing.

25 USDT for the Elite Card & Black Card

Monthly card maintenance fees are:

49 USDT for Elite

99 USDT for Black

All fees are clearly displayed—no hidden charges, just full transparency.

Referral details and reward amounts may vary—check your dashboard for the latest terms.